Launched in 1976, Bankrate has an extended reputation of assisting persons make smart financial choices. We’ve maintained this popularity for over four many years by demystifying the economic final decision-creating procedure and offering people today confidence through which actions to just take upcoming. Bankrate follows a rigid editorial coverage, so that you can have faith in that we’re putting your pursuits first.

Don't ignore accounts that aren’t on your own credit report, both. These could sooner or later be described, particularly if you drop guiding on payments. Your aim is to show creditors that your monetary mishaps are guiding you and gradually raise your credit rating as time passes.

There isn't a minimal volume of personal debt necessary to file for bankruptcy. That said, In case you have lower than $ten,000 really worth of unsecured credit card debt, it’s probably not worth it because of attorney service fees, plus very long-time period consequences. Filing for personal bankruptcy can deliver aid if you’re overcome with personal debt and struggling to shell out your debts when preserving a least typical of residing.

It may sound right to check with yourself no matter whether credit card personal debt settlement is the best path to go after. With this option, the purpose should be to get your lenders to simply accept a lump-sum payment for less than the total harmony, which can offer many aid to those with too much to handle amounts of credit card financial debt.

As noted over, a individual bankruptcy will linger on the credit report for as many as a decade. This, however, does not suggest You can't qualify to get a mortgage for ten years.

Bankrate’s editorial workforce writes on behalf of YOU – the reader. Our aim will be to supply you with the most effective guidance to help you make sensible private finance decisions. We observe rigorous pointers making sure that you could check here our editorial content material is not motivated by advertisers.

“That’s because higher fascination prices compound promptly and might maintain you in debt additional info for a very long time. So, in case you pay back more within the financial debt with the best interest rate, you’ll lessen the amount of money you invest on desire every month.”

LendingTree is an online personal loan marketplace For each and every form of borrowing, from automobile financial loans to credit cards and beyond. When you're trying to find a loan to repay your existing significant curiosity credit card debt, You may use this assistance to easily Evaluate features from up to five lenders at a time, aiding you accessibility the very best rates and conditions for your personal loan.

Be wary of any organization that assures individual bankruptcy removing. In the event your personal bankruptcy report is exact, there's nothing these firms can legally do for yourself which you can't do yourself.

In the event your additional resources insurance policy satisfies these needs and we haven’t discovered it, ensure that the account used to make payments is linked.

But before you think about possibly, permit your self enough time to look what i found operate on improving upon your economical condition.

Bankrate follows a stringent editorial policy, in order to have confidence in that we’re Placing your passions very first. Our award-winning editors and reporters build genuine and precise content to assist you to make the appropriate economical selections. Important Ideas

You might want to receive a continuous annual profits in these respective occupations to qualify for such a personal bankruptcy.

Portion of your respective credit score is based on how many new credit programs you make. Steer see this here clear of putting in many new credit card or bank loan purposes simultaneously, specially for those who’re finding turned down.

Shaun Weiss Then & Now!

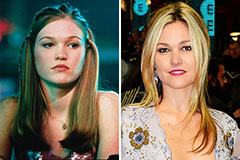

Shaun Weiss Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!